TaxFD Payroll

Modern, Full Service Payroll

Smart, modern payroll processing save you hours of time by streamline time reporting, payroll processing, payroll filing, and benefit administration.

You're Fully Covered

TaxFD and payroll processors work closely to take care of all payroll needs on your behalf. Our integrated approach identifies payroll needs and...

- Direct deposit from your account into your employee’s bank account on your preferred schedule

- Automatic payment of federal, state, and local payroll taxes

- Filing of monthly, quarterly, and annual payroll tax reports, including W-2, W-3, and 1099 forms

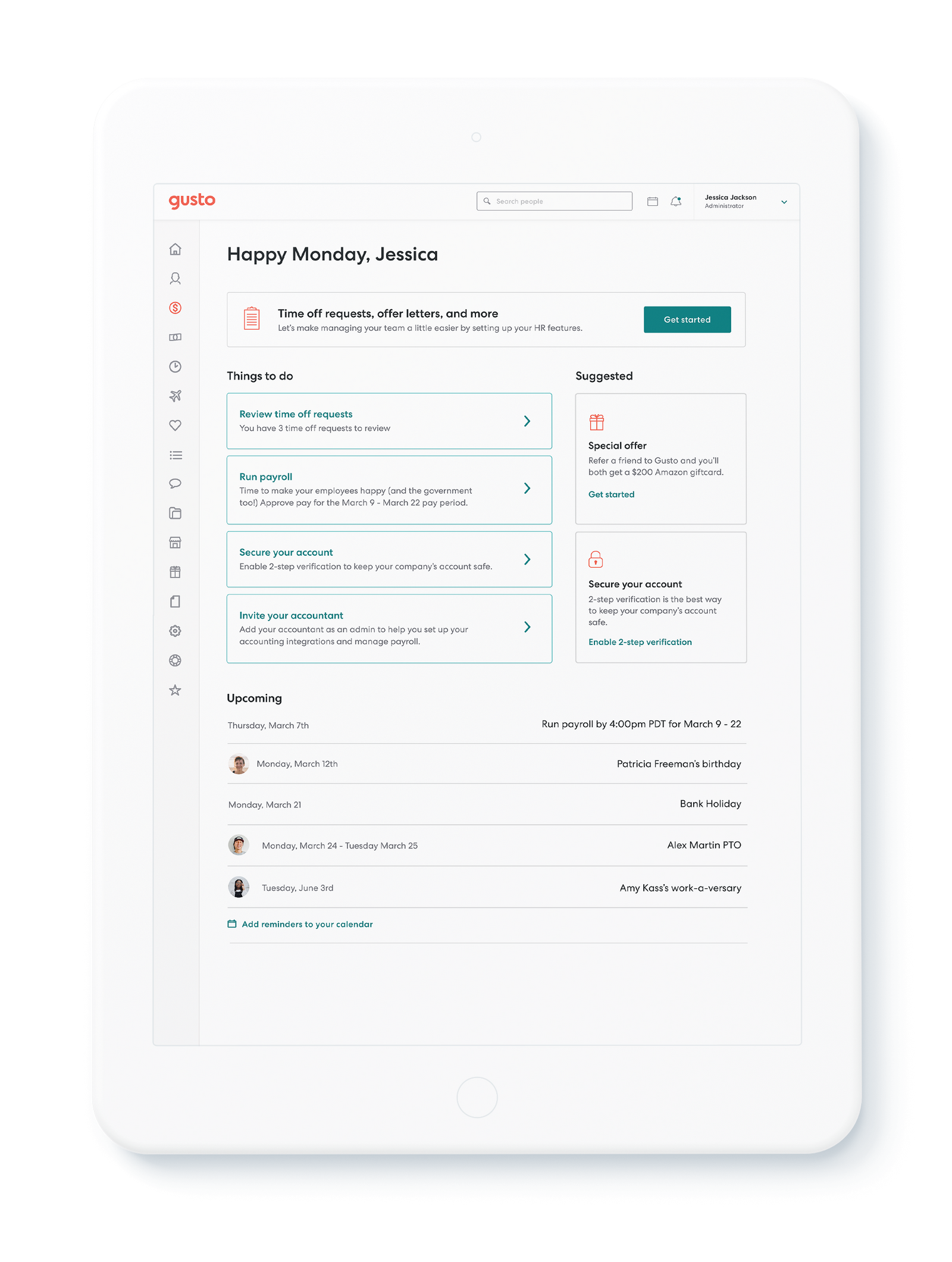

- Payroll dashboard for easy review and approval, including gross and net pay, deduction reporting, vacation, sick, and personal day reporting, and employee benefit management

Getting started

Onboarding with TaxFD Payroll

Whether you are starting a business, acquiring an existing dental practice, or looking to migrate your existing business' payroll to a more robust, comprehensive provider, we make the process simple.

Payroll Solutions for

Dental Practices

No matter the size of your dental practice, we recognize the unique challenges and opportunities at your business stages. Our tailored solutions are designed to adapt alongside your practice, ensuring that you have the necessary tools and support to thrive, whether as an independent contractor, first time owner, established owner, or DSO.

Payroll For

Independent Contractor Dentists

Do you have a S-Corporation? Even as a solo-owner S-Corporation, your business is required to run payroll like any full business. TaxFD simplifies payroll management for independent contractor dentists with automated tax calculations, direct deposits, and easy access to financial tools. Our expert team seeks compliance with tax laws, allowing your business not to be come a burden.

Payroll For

Start-Up Dental Practices

Starting a dental practice can be a daunting task, but with TaxFD, you can hit the ground running.

Our payroll systems are designed to meet the unique needs of new businesses, offering quick setup, competitive pricing, and comprehensive support. Importantly, TaxFD ensures you won't miss your first payroll for your employees. From employee onboarding to automated tax calculations, we equip start-ups with the tools necessary for a successful launch.

Payroll For

Dental Practice Acquisitions

Navigating an acquisition requires careful planning and precise execution. TaxFD understands the complexities involved in merging payroll systems and employee benefits.

Our expert team is here to streamline the transition, ensuring compliance with regulations and a seamless integration of workforces. We provide dedicated support throughout the process to make sure you won't miss your first payroll for your employees, allowing you to focus on building a strong, unified practice.

Payroll for

Established Dental Practices

For established dental practices, efficiency and accuracy are paramount. TaxFD offers advanced payroll solutions tailored to your current processes. With features such as unlimited payroll runs, on-demand access, and automated compliance, we help you manage your existing workforce while enabling growth, profitability, and employee satisfaction.

Payroll for

Multi-Location Dental Practices

Managing payroll across multiple locations can be challenging. TaxFD simplifies this process with its robust system designed for multi-location offices, ensuring compliance with various state regulations and unique tax requirements. Our centralized platform allows for easy management of all locations, providing real-time access to payroll data, employee benefits, and a dedicated support team to assist with any inquiries.

TaxFD Preferred Payroll Processors

As a professional payroll and accounting firm, TaxFD uses leading payroll processing platforms to support our clients. These platforms provide businesses and their employees with online platforms to process payroll and round-the-clock support, while receiving personalized oversight from TaxFD.

TaxFD Preferred Payroll Processor

Gusto

Our Gold Partnership with Gusto is the highest tier available to accounting and payroll firms demonstrating our experience helping hundreds of businesses grow with Gusto and have access to all the platform has to offer. Through our partnership, we go beyond full-service payroll to handle employee benefits, 401K, PTO, and more, all in one easy-to-manage place.

Our experience and expertise in Gusto provide our clients with an exclusive VIP level support, dedicated account management, direct influence in product development, and white-glove onboarding.

TaxFD Preferred Payroll Processor

ADP

As an ADP Certified Partner, TaxFD has demonstrated the knowledge, skills, and expertise needed to perform critical payroll functions in RUN Powered by ADP®. This experience provides our clients with exclusive benefits through ADP including dedicated support resources and onboarding.

Frequently Asked Questions

HOW DO YOU HELP WITH MY PAYROLL, TAXES, AND FILINGS?

Yes, all local, state and federal payroll taxes are calculated, filed, and paid automatically.

Contact us to get started. While we are generally booked out between 3-6 months for new clients, we understand payroll is an urgent, core function of your business that we can onboard ASAP.

We will work with you and the employee to process wage garnishments for tax, child support, and more. You'll know how to report all garnishments received for prompt processing.

Your payroll processor will automatically report new hires to the government for you. If you'd like to not file the new hire report for an employee, you can choose not to file it.

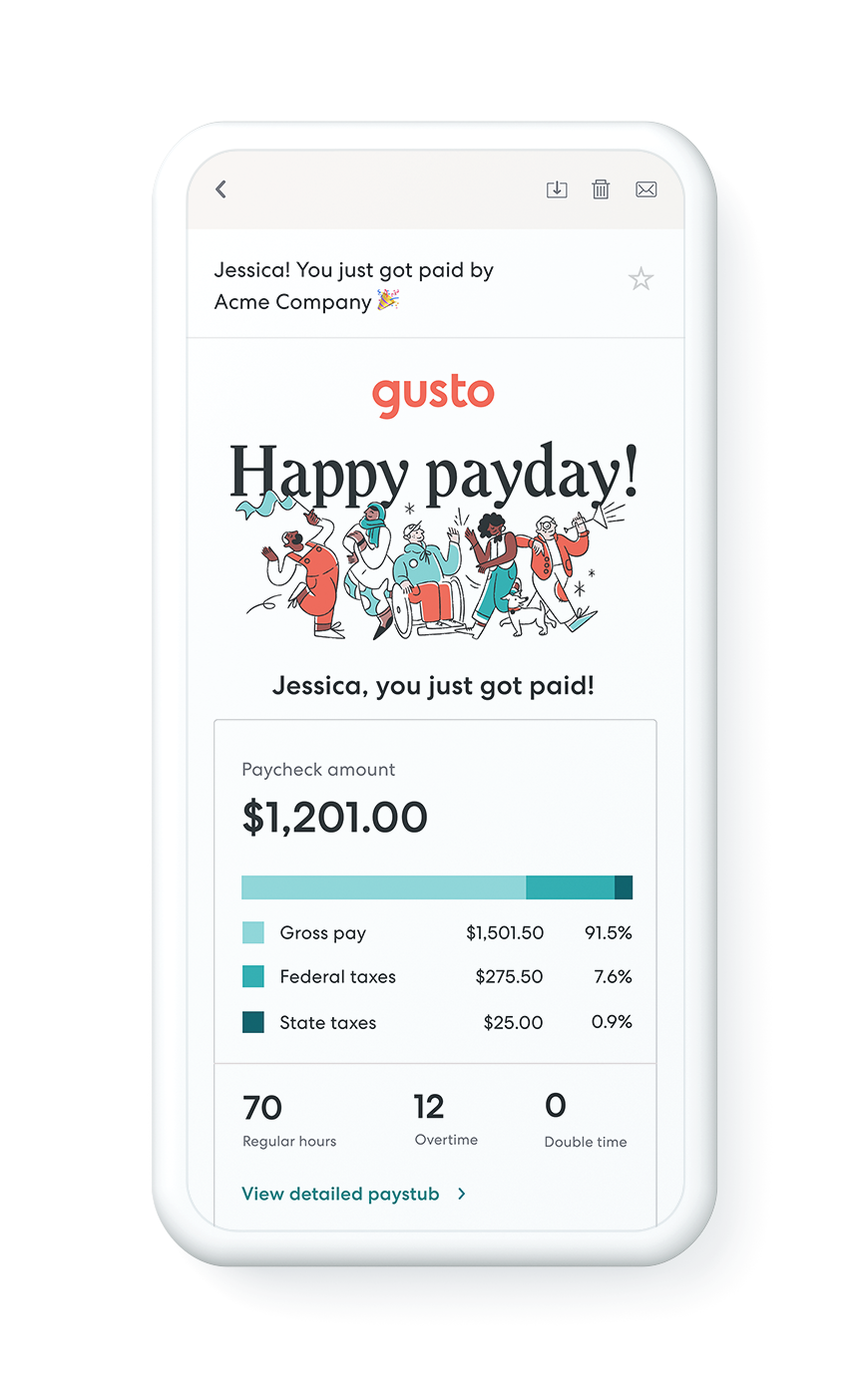

On payday your employees will receive an email with a link to their full paystubs. They will have lifetime access to an online portal to access all paystubs and W-2s in one place.

Of course, direct deposit is available along with a fully digital onboarding process. We can also support your employees to be paid by check or a pre-loaded card.

We do not track your employees' time. For an additional cost, we can provide you with time tracking software. We will help you develop a time tracking process that works for your business.

In most cases, dental practices will use the time clock in their practice management software. This tends to be the most cost-effective and consistent solution.

You can run payroll as frequently as you'd like. While most businesses process payroll bi-weekly or twice-monthly, you can set a schedule that works best for you. We do not charge based on the number of times you process payroll.

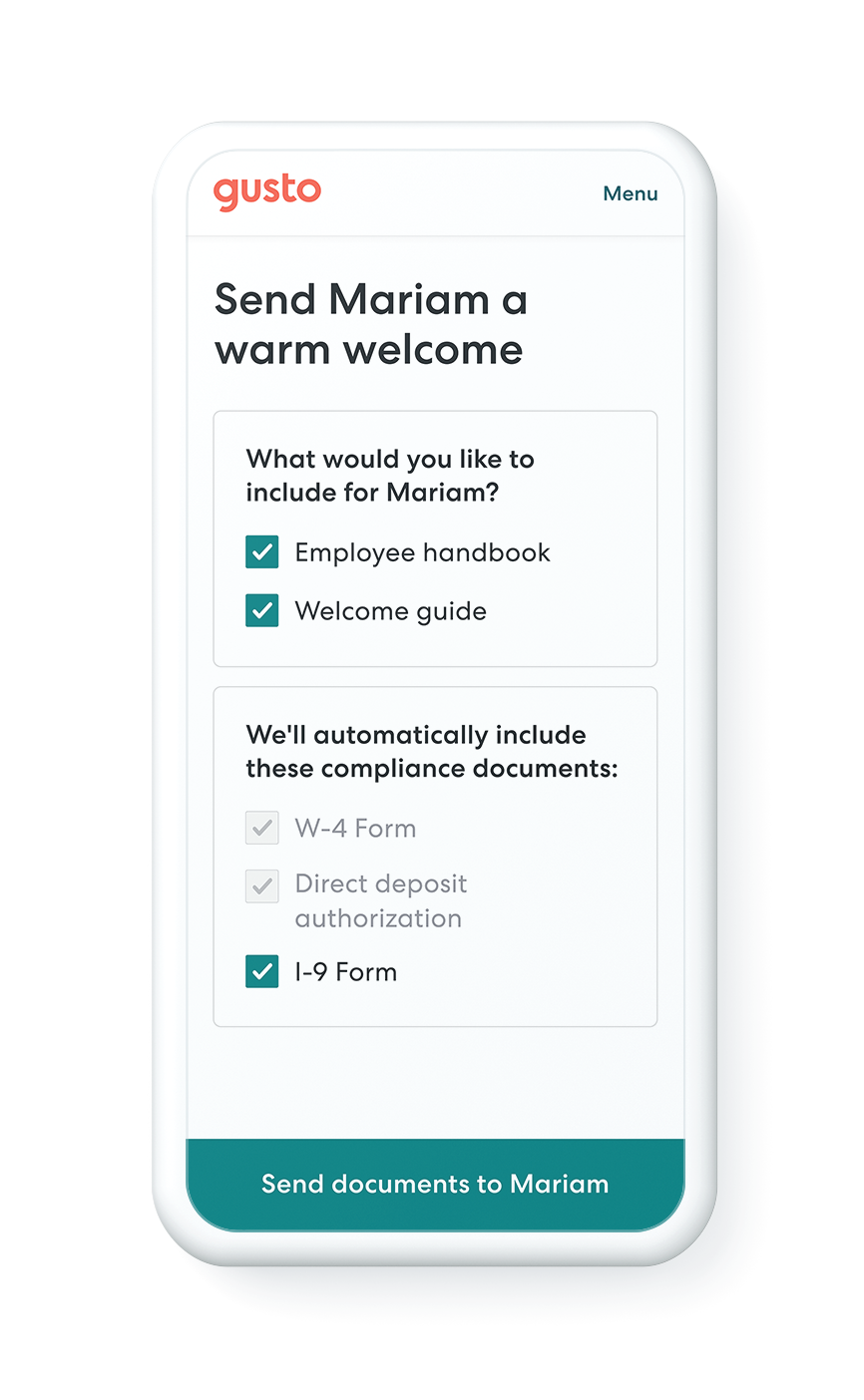

As part of your initial training, we will show you how to "hire" new employees in your payroll system. You will enter basic info like their name, pay rate, position, and email, then they will receive an email invitation with instructions to fully register online.

For employees that have difficulties with an online onboarding process, you can complete the registration with them or receive paper forms to complete payroll registration.

You will be able to onboard and process ongoing payments to independent contractors. For contractors onboarded through your payroll portal, we’ll automatically file and email them their 1099s at the end of the year.

Not directly, but we partner with HomeWork Solutions for this service. As a TaxFD client, you will be eligible for the enrollment fee to be waived.

WHAT FORMS DO YOU FILE?

Annual report of wages, tips, and other compensation paid to an employee, as well as the employee's taxes withheld.

Annual report of payments made to an unincorporated business or independent contractor showing total self-employment income.

If you're claiming the Federal R&D Tax Credit, we'll file Form 8974 to claim your credit against your payroll tax liability.

Annual report of federal wages, tax withheld from employees, employer's portion of social security or medicare.

Quarterly reports of federal wages, tax withheld from employees, employer's portion of social security or medicare.

We file your state and local payroll tax returns, and will help register your business with needed agencies.

CAN YOU HELP MANAGE EMPLOYEE BENEFIT PROGRAMS?

Through WealthFD, we're able to support your retirement in all 50 states. Our integrations make it simple, eliminating the need for physical enrollment packages, mailing checks, and manually changing employee's contribution elections.

While we are not insurance brokers, we're able to work directly with health insurance brokers to recommend health insurance options for your business. The employee portion of health insurance premiums will be withheld each pay period and all premiums will be reported on the W-2.

Your employee's paid and unpaid time off balances are tracked and accrued automatically according to your policy. Employees will be able to see their time off balances on every paystub.

We do not provide HR services, but can refer you to companies that can help.